9 Easy Facts About Succentrix Business Advisors Shown

9 Easy Facts About Succentrix Business Advisors Shown

Blog Article

Succentrix Business Advisors Fundamentals Explained

Table of ContentsSuccentrix Business Advisors - The FactsThe Best Strategy To Use For Succentrix Business AdvisorsUnknown Facts About Succentrix Business AdvisorsThe Facts About Succentrix Business Advisors UncoveredSuccentrix Business Advisors Things To Know Before You Get This

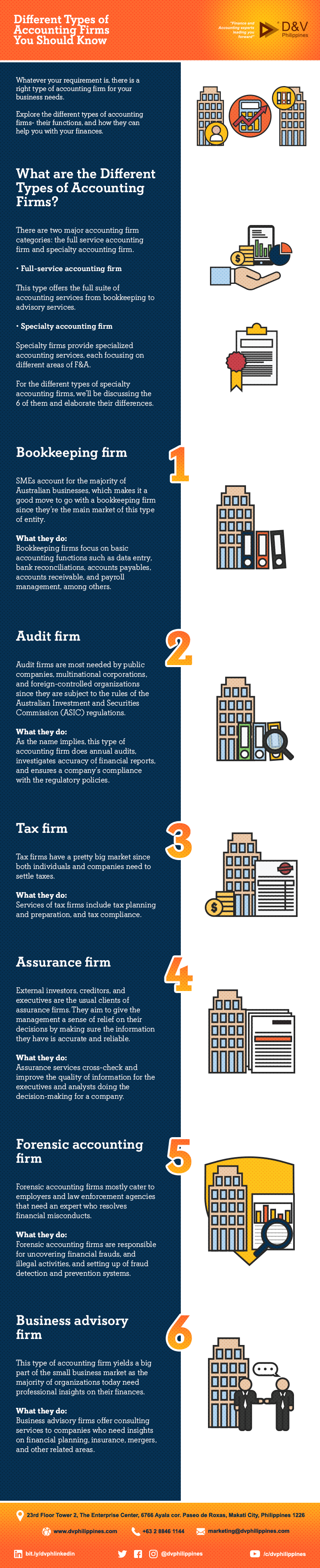

The structure and capabilities of the company depend on scale and array of services. The performance of work relies on technical remedies. Specialist software application is a must. Firms make use of innovative programs to automate and simplify working processes. Accountancy business intend to provide quality services that aid businesses and individuals manage their funds and make sound choices about their money.CAS firms concentrate on advising audit solutions instead than a compliance-heavy service. This fad in the accountancy industry shifts to an emphasis on consultatory bookkeeping solutions instead than a compliance-heavy solution.

Let's get our phrases right. Currently that we know what to call it, allow's find out about what it is! Historically, accounting businesses have been concentrated on the compliance side of points.

According to the & AICPA PCPS 2018 CAS Benchmark Survey Report, the 5 most common client audit consultatory services provided are: 1099 production and filing (91%) Monetary statement prep work (89%) CFO/Controller Advisory solutions (88%) Accounts payable (86%) Sales tax returns (85%) Rather than concentrating on simply the core i.e., tax obligations, purchases, and things that have actually already happened, CAS firms likewise concentrate on the future and try to assist their customers remain aggressive and make the best choices for their company holistically.

Not known Details About Succentrix Business Advisors

Conformity is the cake, and advising services are the icing on top.

CAS design, and summary specifically what solutions their customers will certainly be receiving. This enables the accounting company to have year rounded money flow and get paid prior to the work is done.

, CAS in bookkeeping companies are reported an average growth price of 16% over the previous year reported by the 2022 AICPA PCPS and CPA.com Administration of a Bookkeeping Method (MAP) company benchmarking research. Cover is a one-stop-shop for all of your accountancy company's requirements. Authorize up totally free to see how our complete collection of services can aid you today.

Running a business includes a great deal of audit. It's a vital part of business procedures. You do it everyday, even if you're not conscious of it. Whenever you tape a deal, prepare tax paperwork, or plan a cost, accounting is involved. You have to do some degree of accounting to run a service, whatever.

Succentrix Business Advisors Fundamentals Explained

If you're not assuming about recordkeeping and accounting, the chances are that your documents are a mess, and you're barely scuffing by. Of course, bookkeeping is a big area, and accountancy services can include several different points.

Audit is concerning producing precise financial documents and keeping reliable recordkeeping methods. Bookkeepers likewise work to create financial statements for you can check here review. All of this drops under audit, but an accounting professional can provide much extra monetary support than somebody whose role drops totally under bookkeeping or recordkeeping.

State-licensed accountants (CPAs) are frequently hired to prepare monetary declarations for businesses or to help with tax obligation declaring at the personal or business level. Public accounting professionals help people to navigate tax regulations and tax obligation returns, and they typically aid services and individuals targeted by tax obligation audits. Federal, state, and regional federal government entities operate a different range than a lot of organizations.

6 Easy Facts About Succentrix Business Advisors Explained

Any public entity that has to abide by these requirements must supply routine monetary statements and yearly records on its financial resources - Find A CPA. Fulfilling these standards requires specialized bookkeeping abilities. Monitoring accountancy is the kind that usually comes right into play for local business. An administration or supervisory accounting professional will certainly help you assess your funds, research market problems, and prepare for the future.

Report this page